Source: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/insurance-industry-s-diversity-scores-show-modest-improvements-70267950

U.S. insurance companies are making strides toward the goal of becoming more diverse, aided by a growing conviction that such steps can help boost company performance.

In addition to posting a year-over-year increase in its S&P Global gender diversity score, the insurance industry’s workforce also became more racially diverse in 2021, according to data compiled by the U.S. Department of Labor.

Consumer and shareholder activism have helped push diversity up corporate agendas in recent years, as has business experience demonstrating the benefits of a more varied workforce. Principal Financial Group Inc., which boasts five female board members, sees a strong business case for growing diversity, especially in leadership positions.

“We know that diverse workforces and inclusive cultures are more likely to exceed financial targets,” said Miriam Lewis, Principal’s chief inclusion officer. Such companies are also “more likely to have [a] high performing organization with more innovation, more agility and … [to] achieve better business outcomes,” she added.

Gender diversity scores tick up

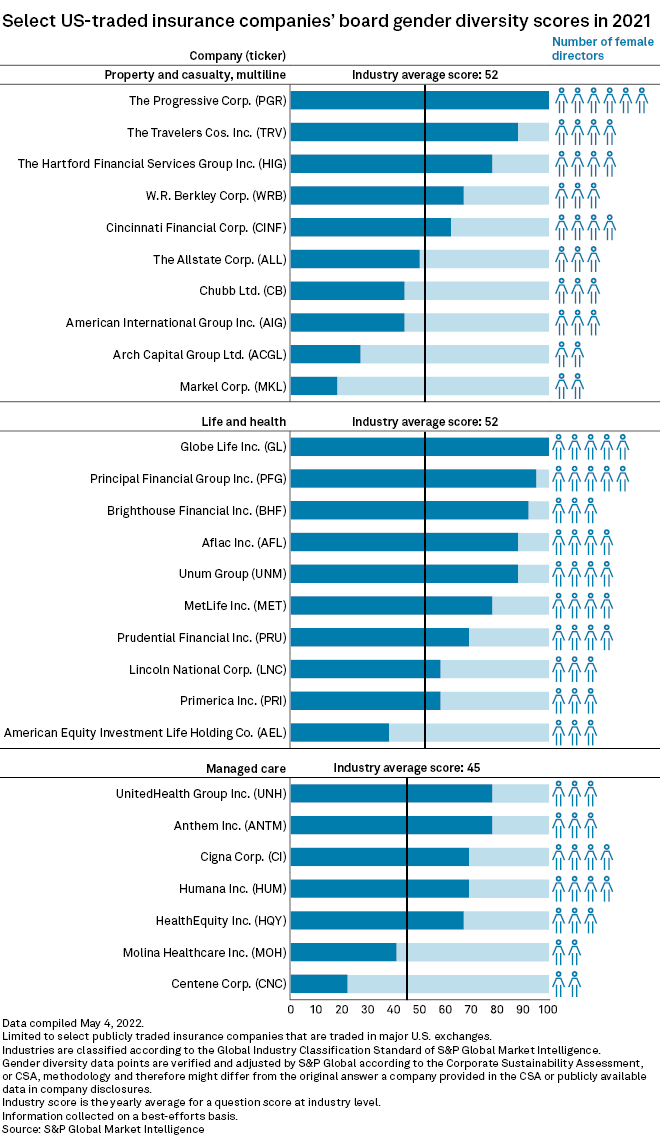

The property and casualty and life insurance sector recorded an average S&P Global gender diversity score of 52 for 2021, while the managed care space had an average score of 45. The scores are calculated from companies’ responses to a 2021 survey on environmental, social and governance issues distributed by S&P Global.

Those scores reflect improvement for the whole insurance industry, as the P&C and life insurance sector held an average S&P Global gender diversity score of 49 in 2020, while managed care’s score was 43 that same year. By comparison, the U.S. banking sector recorded a gender diversity score of 40 in 2021, up from 35 in 2020.

Scores are not available prior to 2020 as that was the first year S&P Global produced ESG scores.

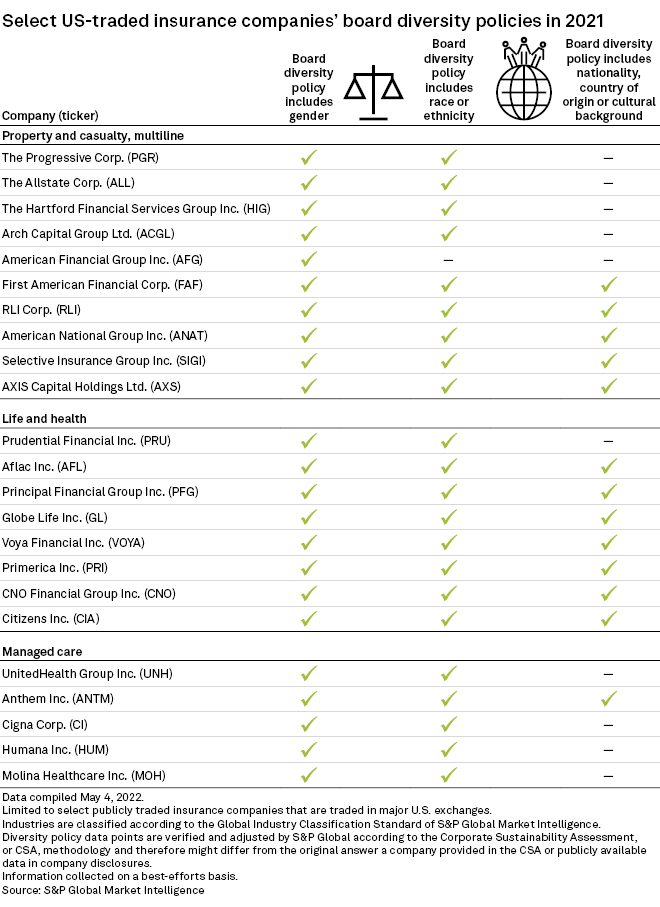

All of the top insurance companies by market capitalization in managed care, P&C and life that provided ESG responses to S&P Global had board diversity policies that included mandates pertaining to gender representation in 2021. Some insurers, however, have yet to implement policies regarding nationality, country of origin or cultural background.

Having a diverse board and leadership team creates richer and fuller discussions, said Lynn White, who leads Genworth Financial Inc.’s ESG efforts as chief of staff.

“The idea is to bring together people with different perspectives, different approaches, so that we can sit and have healthy tension and debate,” White said in an interview. “When we come out of that, we’ve got better decisioning.”

The push for greater diversity on company boards represents a larger cross-sector trend. In 2021, companies in the S&P 500 ushered in the most diverse class of new directors ever, with 33% being Black or African American versus 11% in 2020, according to the 2021 U.S. Spencer Stuart Board Index. Female representation on boards of S&P 500 companies also increased to 30% in 2021.

Regulator involvement

The National Association of Insurance Commissioners has launched efforts to identify issues and to develop specific recommendations on action steps that state regulators and insurance companies themselves can take to improve diversity in the industry.

At the most recent NAIC meeting, My Chi To, executive deputy superintendent of insurance at the New York State Department of Financial Services, said she has seen progress and increased engagement.

“The testimony across all of these formal and informal conversations has been remarkably consistent,” To said. “Both the recognition that the industry can and should do more to improve the level of diversity within our ranks, but also the level of diversity and commitment that already exists to make this happen.”

In addition to bolstering gender diversity, the insurance industry also became more diverse with regard to race and ethnicity in 2021, according to data compiled by the U.S. Bureau of Labor Statistics. The percentage of nonwhite employees in the insurance workforce, which includes insurance carriers and “related activities,” stood at 22.1% in 2021, an increase from 21.4% in 2020.

The percentage of Black or African American employees in the insurance workforce grew to 13.2% in 2021, up from 12.0% in 2020. Asian representation, however, declined to 6.4% of the workforce in 2021 from 7.1% in 2020.

The NAIC is “intentional” about making diversity, equity and inclusion an integral part of its own culture, Evelyn Boswell, the group’s director of DE&I, said in an interview.

“It’s not just words,” Boswell said. “We’re putting action behind those words.”