The Value Gap is a MarketWatch Q&A series with business leaders, academics, authors, policymakers and activists on reducing racial and social inequalities.

Picture two homes the same size, each built in the same year and in the same condition, both in neighborhoods with similarly decent public schools and access to amenities like libraries, museums and restaurants — but one is worth $48,000 less.

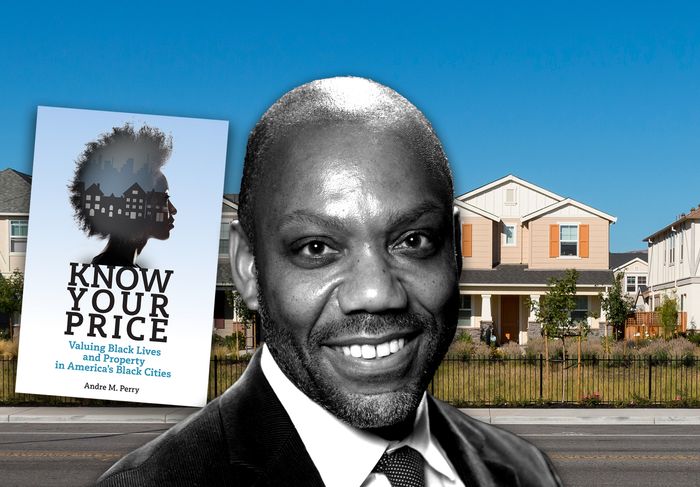

What explains the difference? The less-valuable home is in a majority-Black neighborhood, while the other is in a neighborhood with very few or no Black residents. This is one of the findings from research co-authored by Andre Perry, a senior fellow at the Brookings Institution.

For years, the impact of centuries of discrimination on Black Americans’ ability to build wealth through one of the most reliable pathways to wealth-building for white Americans — homeownership — has been clear.

But what makes Perry’s research so interesting is that he controls for those factors — for example, lower wealth in Black communities means that the housing stock often isn’t as good and the public schools have less funding — and still finds that homes in majority-Black communities aren’t worth as much as those where there are very few Black people.

That, to Perry, is evidence that it’s not just past policies that explain the racial wealth gap. Racism today is also contributing.

He points to 2021 research from Freddie Mac indicating that homes in majority-minority neighborhoods are more likely than those in majority-white neighborhoods to receive appraisals that are below the price that buyers and sellers agree on. But he finds evidence in other areas of the housing market and in other markets as well.

Perry expanded his 2018 research into a book, “Know Your Price: Valuing Black Lives and Property in America’s Black Cities,” published in 2020. MarketWatch spoke with Perry about his housing research, the role of debt in devaluing Black property, and the true indications of a power shift. The conversation has been edited and condensed.

MarketWatch: Let’s start with your book. In the title, you talk about the idea of Black lives and Black property. A lot of people are familiar with the concept of Black Lives Matter and the movement. But why is it important to consider the value of Black property when you’re talking about that issue?

Perry: We found that homes in Black neighborhoods are underpriced by 23%, about $48,000 per home. Cumulatively, that’s about $158 billion in lost equity. That’s a concrete material loss that people living in Black communities grapple with, but it’s also a metaphor on how we are valued overall. Our lives are much more valuable than we are priced, so to speak.

When I wrote the book, I certainly wanted to build upon the work on housing, but it was more about [getting] us to see that it is not Black people that are at fault for this state of our communities and our lives. There is a penalty for being Black; there is a penalty for living in Black neighborhoods that extract wealth and opportunity and years of our lives.

I say that there’s nothing wrong with Black people that ending racism can’t solve, but I really wanted to show that and use data. The numbers are compelling and they’re important, but it’s more about our lives and how Black people are systematically devalued in many different ways.

MarketWatch: How does the devaluation of lives end up playing out in the devaluation of property, and what about the opposite — what does the devaluation of property do to people’s lives?

Perry: There has been a lot of conversation about [the impact of] redlining and past discrimination on current-day outcomes. A lot of people point to that and they will say how that was an explicit form of racism that clearly extracted wealth from communities for generations, and that is true, that is absolutely true. It robbed people of the ability to create wealth and if you have less wealth, you have less opportunity to send your kid to college, to start businesses, to invest in your community.

This is not only about the past — the 23% difference indicates that there are still dregs of racism in our community that we allow. Just as in the past it was normal to discriminate against Black people, we have normalized racism in ways today that we don’t see.

When people look at my research, I want them to have the evidence that there’s something in our markets, there’s something in our policies that are today extracting wealth and opportunity. Devaluation in housing is robbing people of opportunities to start businesses, to go to college today. This is not in the ’30s, ’40s, ’50s, this is today.

Our outcomes reflect that discrimination; whether it’s recognized or not, it’s there. We need to identify it, eliminate it and restore the value that’s been extracted by racism.

MarketWatch: One thing that I thought was really interesting about your 2018 research was the way that you controlled for historical discrimination or all of the things that we know, then still find that there’s this unexplained — it’s not unexplained, but unexplained — difference in property values. When you think about the policy response or just general response, how is it different once you start realizing that these things are still going on today?

Perry: It’s different in that we have a Fair Housing Act that was passed that a lot of people say, “Oh, that bill was passed, therefore there is no more discrimination,” but many of the practices that we use today are vestiges or relics of that segregated past. [Editor’s note: The Fair Housing Act, enacted in 1968, prohibits providers of housing as well as banks and lending institutions from discriminating against home seekers based on race, sex, religion and other protected classes.]

The price comparison level that is still used predominantly today by appraisers is the practice that was used to suppress Black people in the past. Many of the practices have not gone away, and they’re hard to remove.

You just can’t get rid of single-family zoning ordinances that have really crept into the culture of society. In many ways there are many parallels to the past; many of the things we did in the past are still with us. Certainly we removed certain language; we forbid certain explicit behaviors — but the definition of structural racism is you don’t necessarily have to do those discrete behaviors to get the same result.

Many of the policies that are in place produce those outcomes regardless of if the person is carrying a tiki torch and wearing a hood in your locale. It doesn’t mean an individual has to hate Black people to get a result that hurts Black people.

That $156 billion in lost equity is the equivalent of 4.4 million Black-owned businesses. It would have paid for more than 8 million four-year degrees; replaced the pipes of Flint, Mich., 3,000 times over. It’s more than double the economic burden of the opioid crisis. It’s a big number. And so if we’re willing to live with that kind of inequality then we’re willing to live with prohibiting Black people from starting businesses, going to college and contributing to their communities. But that’s something that I cannot live with.

I also believe that people will act properly when they have facts in front of them, so I don’t have to yell “This is racism” or blame people, I can show them facts. I trust that people will act on it. That’s what’s happening all across the country. People are latching onto a lot of the appraisal issues by getting white stand-ins after their home has been appraised for much lower than it should have been. They’re whitewashing their homes and getting a second opinion and their appraisals are coming in higher.

But I also believe that appraisers aren’t the only ones involved in devaluation. In the housing market alone, you have real-estate agents, you have lenders, you have other actors that grew up in the same places — they have the same perceptions, they have the same values.

For me, I don’t want my work compartmentalized only in housing either. I also try to say this is happening in many different markets in many different areas of life, and we must address them accordingly.

MarketWatch: What are some of the other areas that you see it in?

Perry: My start in policy was actually in education. I was an education researcher for so long, but I got so tired of education reformers, members of the business community and the population in general arguing that if we could only fix schools everything could be all right.

If you really believe that, then you almost have to fix housing policy because a large part of school funding comes from the taxes that are assessed on the value of homes. Then I started saying, “Hey, most people start businesses using the equity of their houses,” so if you want to really increase the percentage of small businesses or employer firms in Black communities, you have got to address housing inequality.

In my personal life, I have a chapter on birthing outcomes and mortality rates, which are inextricably linked to the conditions that women face every day.

If you want to improve health outcomes, you’ve got to improve criminal-justice policy, education policy, wage discrimination and the like. All of these things are interconnected. If we have the range of people working on the range of issues that are at play and assuming that Black people are not the problem, then we can take small bites of that elephant in many different sectors, leading towards a more equitable society.

‘2020 was a pivotal moment, but we need to sustain it with policy and a deeper conversation about power in this country.’

MarketWatch: Your work predates this, but there’s been more attention to the racial wealth gap from business, politics, etc., over the past year and a half or so. How effective has that attention been in actually addressing some of these problems?

Perry: The racial uprisings of 2020 will undoubtedly go down as a historic moment in time. It brought attention to how casually life is snuffed out, not only from police violence, but from policy violence as well. A lot of the empathy and sympathetic feelings that came out in the form of charity and philanthropy was important, but it was not sustainable.

Most Americans — I say most, and it is a small majority — but most Americans want equality. However, most Americans aren’t necessarily willing to give up the power and the privileges that inequality has provided over the generations.

Ask any hardworking liberal Democrat who lives in a well-resourced school district, do they want to change the funding formula that would redirect funds in a way that doesn’t privilege their district? They’ll say no. Much of the Not In My Backyard pushback to affordability and density comes from communities that are progressive.

I think 2020 was a pivotal moment, but we need to sustain it with policy and a deeper conversation about power in this country. I’m working on a book called the “Black Power Scorecard.” It’s going to provide a power analysis in communities.

Yes, I want to see Black people be able to generate wealth; I want us to have better life outcomes. That won’t happen by just giving Black people money, there has to be a dismantling of the architecture of inequality that facilitates a power differential that makes equality a pipe dream. We must have deeper conversations about power moving forward.

MarketWatch: What would be a legitimate sign to you that the power structure has changed? We’ll sometimes see companies put one person of color on a board or whatever, but what shows that we’ve actually changed the power structure?

Perry: I crack up whenever there’s a new Black person on the Forbes list of the wealthiest people, as if that’s an indication that Black people are getting more power. I say don’t look at whether or not we have wealthy individuals, look at median wealth in this country. That’s an indication of power.

Look at who is in control of boards that control water in places like Jackson, Miss. Look at the governance structures that can preempt policies that would bring infrastructure to Black communities. For me it’s a range of indicators in terms of: Are we in positions of authority? Are resources distributed equitably? Are Black people getting the value that’s been extracted by racism? Are we disempowering racist individuals in local communities? Do we have curricula that reflect accurate history?

These are the kinds of things that I will examine in the book; these are these indicators of whether or not power is shifting in this country.

MarketWatch: Circling back to the devaluation of property — I cover mostly student debt, but some other topics too — where do you see the role of debt in general fitting into how assets and property are devalued?

Perry: Black people have to take on more debt because we were denied wealth categorically in different areas. Most people acquire wealth through homeownership, but let’s not forget that slavery, Jim Crow racism, a racially biased criminal-justice system, literally extracts people from markets.

All of these contribute to a wealth gap. When you have lower wealth, you almost have to take on some form of debt in order to withstand economic shocks, to participate in markets.

Related: ‘I can’t imagine the day when I’m not paying.’ Black women are being crushed by the student debt crisis — and demanding action

One of the reasons why I became interested in the student-debt issue is really because higher education has become as basic as a K-12 education. We’re asking people to go to college to benefit society, but we’re asking them to pay for it — but not just pay for it, to go into significant debt to do so, which throttles the impact of the jobs that they’re getting. It influences the job that they take and it furthers the wealth divide.

We should eliminate the debts that are undeniably tied to past discrimination. It’s not only student-loan debt; medical bills, medical debt is also hindering people’s ability to buy homes and start businesses. Credit-card debt. You see who takes on more credit-card debt after every economic shock. When you can’t pull from a 401(k), when you can’t pull from home equity, you use your credit card, and Black people are burdened by a number of forms of debt.

We also need to rethink our credit-scoring system. There’s no question that our credit scores reflect discrimination in this country. What would our credit scores look like if we did not deny Black people homeownership, if we did not have labor discrimination? What would our credit scores look like? They would be fundamentally different.

So many of our systems still reflect the discrimination of the past and present and we need to not only restore the value, we need to correct the systems that further those wealth divides moving forward.

For me, the canceling student debt issue is just one step toward a solution to a broader problem. If we canceled all the student debt today and did not correct for a system that allows for that kind of debt accumulation, people 10 years down the road are going to have more debt. We need to use this moment as a lever to get towards some sort of free college.

MarketWatch: You mention that there’s good reason to cancel other types of debt. Do you see student-debt cancellation as a lead-in to those other possibilities?

Perry: Student-debt cancellation for me is akin to medical debt — both debts, for me, come from systems that we need to change. We need to change the higher education system and we need to have a healthcare system that provides healthcare to individuals who need it and not have them pay for it. Those two are big ones for me.

MarketWatch: In your book there are moments where you talk about your personal experience. At what point in your life did you realize that your personal experience was part of these broader issues?

Perry: You realize it when you’re on a panel and people are talking about Black people as if you’re not Black, as if your experiences somehow are different from the Black people that scholars are talking about.

One of the questions I get all the time when people learn that my father was murdered in jail — they’ll say, “Why are you so different? How did you end up so different from your father?” I say, well, I am no different. I share genetics, I grew up in the same kind of neighborhood, same family background. We have systems that scoop up potential scholars every single day; I’m no different.

You have policies that if someone who was a fact-based Black person was in the room, it would not have gone down. Can you imagine how the Moynihan Report — in which they effectively blamed Black women for the state of Black America — can you imagine what that would have looked like if Black women scholars were in the room, working on these policies? The Moynihan report would not have looked the way that it did.

[Editor’s note: The report produced by then-assistant Secretary of Labor Daniel Patrick Moynihan in 1965 said that “at the heart of the deterioration of the fabric of Negro society is the deterioration of the Negro family.”]

I want to bring my personal stories into view, because I also want all scholars to do the same. Scholars of privilege need to acknowledge their privilege; they need to show how their worldview shapes their research, just as my worldview shapes my research. It’s impossible to separate yourself from your upbringing.

In this case, we are realizing that Black perspectives really bring insights that are desperately needed for democracy to work — so I think my work is getting a lot of attention because of that.