Most Black parents begin saving for college before their child is 10 years old and this could be a future key to closing the racial wealth gap. Unfortunately, only 16% of African American parents are saving for college using a 529 plan, which is like a prepaid tuition program, according to Northwestern Mutual. Even though parents are saving more for college now than ever before, their preparedness could still use improvement, and a solid 529 plan could put their children on the path to success.

Why This Matters: Our future Black leaders will most likely need a college degree to succeed. A national study by Sallie Mae found that 47% of African-American and Hispanic parents are more likely to report they have a plan for paying for college than White parents at just 42%. In fact, 84% of parents believe their child will earn more money with a college degree.

Despite the benefits of saving for college with a 529 plan, 45% of parents continue to keep their college savings in a general bank account. The difference among racial/ethnic parent groups saving for college is persistent across income levels. Unfortunately, 35% of Black parents plan to rely on loans to fund some portion of their child’s college education costs.

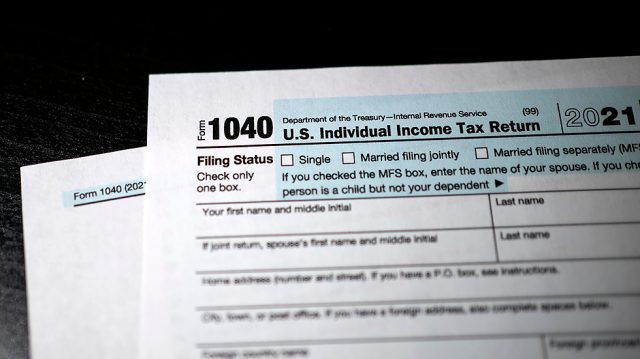

There are other benefits for parents using 529 plans prior to college enrollment. The Tax Cuts and Jobs Act broadened allowable uses to include distributions of up to $10,000 annually for private K-12 education. Savings like this could allow parents to put their kids in better schools long before they head off to their prospective universities.

Situational Awareness: It’s important to remember that a 529 prepaid plan gives parents the benefit to lock in the cost of college tuition at today’s contract rates, ensuring that their child’s future education is secure. Not to mention the plethora of federal tax breaks parents who contribute to a 529 will receive, which can go a long way towards improving a family’s financial security for their college bound kids.