LPL Financial Holdings, Inc.

CHARLOTTE, N.C., Sept. 19, 2022 (GLOBE NEWSWIRE) — LPL Financial LLC (Nasdaq: LPLA) announced today that it won two awards at the Wealth Management “Wealthies” industry awards program that recognizes outstanding organizations that support financial advisor success. LPL earned recognition(1) for its Diversity, Equity and Inclusion efforts and its innovative ClientWorks Meeting Manager solution.

Around the Table: Black Advisor Voices wins for Diversity, Equity and Inclusion

As part of its strategy to facilitate inclusive discussions within its Black Financial Advisor Business Community, LPL launched Around the Table: Black Advisor Voices. The video series features honest conversations among LPL leaders and advisors from a variety of backgrounds, about how embracing diversity and inclusion can enhance and lead to advisor business growth.

The series premiered during Black History Month and featured Black advisors sharing their unique perspectives on overcoming barriers to success, why they chose to become financial advisors, the importance of mentorship, and how the industry can better serve the Black community, among other topics. The series was shared across advisor, employee, industry and client audiences.

LPL’s Chief Marketing and Communication Officer, Heather Randolph Carter, said, “The Black advisors who shared their perspectives in this series enrich the dialogue within our industry and deepen our understanding of what it means to work toward an inclusive financial system for all. It’s a privilege to be able to offer a platform that gives voice to these important topics, and we are grateful for the partnership from this talented and experienced group of advisors.”

LPL’s Black Advisor Business Community is one of five Advisor Business Communities at LPL that gather regularly and interact online to discuss topics of interest and deepen their community connections. The growing Communities program is one way LPL works to encourage a more diverse and inclusive industry and to empower advisors in their roles as advisors, business owners and change agents.

Meeting Manager Awarded for Technology Innovation

Meeting Manager was designed to solve a common problem facing advisors. With a focus on providing a personalized client experience, advisors were spending hours preparing for client meetings. With an understanding that meetings play an important role in the client-advisor relationship, LPL implemented Meeting Manager into its digital platform, ClientWorks.

This proprietary meeting preparation solution is available at no additional cost, and streamlines workflows, making it easy for advisors to schedule, run, follow-up and complete meetings. It also reduces administrative tasks, with features including the ability to customize and create templates, schedule documents to be available pre-meeting and reduce risk by tracking fulfillment of client meeting requirements. Advisors can submit compliance forms directly from the system and store meeting documents for future reference.

With Meeting Manager, advisors can spend more time engaging in meaningful, client-facing conversations rather than meeting preparation. With LPL’s digital tools, advisors are able to deliver more value to clients, making technology a strategic enabler to their practices.

Related

Learn how LPL Technology is designed to give advisors more time for building relationships with their clients.

Find out more about how LPL supports a culture of diversity and inclusion.

About LPL FinancialLPL Financial (Nasdaq: LPLA) was founded on the principle that the firm should work for the advisor, and not the other way around. Today, LPL is a leader in the markets we serve,* supporting nearly 21,000 financial advisors, and approximately 1,100 institution-based investment programs and approximately 500 independent RIA firms nationwide. We are steadfast in our commitment to the advisor-centered model and the belief that Americans deserve access to personalized guidance from a financial advisor. At LPL, independence means that advisors have the freedom they deserve to choose the business model, services, and technology resources that allow them to run their perfect practice. And they have the freedom to manage their client relationships, because they know their clients best. Simply put, we take care of our advisors, so they can take care of their clients.

(1) Now in its 8th year, the Industry Awards program recognizes outstanding organizations and individuals that support financial advisor success. More than 300 companies submitted a record-setting 900 nominations in 2022 — a testament to the value that firms place in the awards as a way to enhance their reputation, increase their brand recognition, and set their organization apart from the competition.

*Top RIA custodian (Cerulli Associates, 2020 U.S. RIA Marketplace Report); No. 1 Independent Broker-Dealer in the U.S. (Based on total revenues, Financial Planning magazine 1996-2021); No. 1 provider of third-party brokerage services to banks and credit unions (2020-2021 Kehrer Bielan Research & Consulting Annual TPM Report); Fortune 500 Company as of June 2021. LPL and its affiliated companies provide financial services only from the United States.

Throughout this communication, the terms “financial advisors” and “advisors” are used to refer to registered representatives and/or investment advisor representatives affiliated with LPL Financial LLC. We routinely disclose information that may be important to shareholders in the “Investor Relations” or “Press Releases” section of our website.

Connect with Us!

https://www.linkedin.com/company/lpl-financial

https://www.facebook.com/LPLFinancialLLC

https://www.youtube.com/user/lplfinancialllc

Media Contact:Media.relations@lplfinancial.com(805) 640-5391

Advertisement

American City Business Journals

General Motors CEO Mary Barra revises return-to-office plan after pushback

General Motors CEO Mary Barra yesterday apologized to salaried workers for the timing of a memo sent late Friday afternoon outlining a new back-to-office policy and delayed the implementation of the plan. The email said that GM employees who had been working remotely during the pandemic would be required later this year to return to the office at least three days a week, the Detroit Free Press reported. The email triggered employee pushback about both the updated policy and the timing of the announcement, leading Barra to partially walk back the decision, announcing Tuesday that the automaker will not implement the requirement this year but that “a more regular, in-person presence” will still be the plan for the future.

Bloomberg

Amazon Raises Hourly Wages at Cost of Almost $1 Billion a Year

(Bloomberg) — Amazon.com Inc. announced a pay increase for hourly workers in the US that it says will take average starting wage for most front-line employees in warehousing and transportation to more than $19 an hour.Most Read from BloombergApple Ditches iPhone Production Increase After Demand FaltersMacKenzie Scott Files for Divorce From Science Teacher HusbandNord Stream Gas Leaks May Be a New Disaster for the ClimateTrump Refuses to Delay Florida Deposition in Phone-Fraud Case Despite Hurri

TheStreet.com

Bed Bath & Beyond Stock: It’s All Over But the Shouting

Best Buy has a fairly unique story in the retail world. The electronics chain appeared to be on its way toward bankruptcy when it made the unconventional choice to hire Hubert Joly — an executive with a hospitality background — to take over the chain. At the time, that move seemed like a misstep, but it turned out to be one of the best hires it retail history.

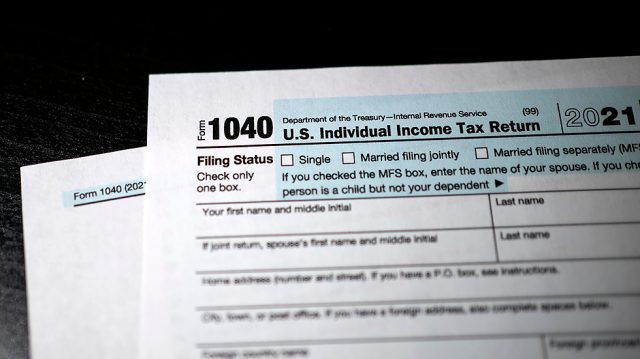

SmartAsset

These Are The Best Ages to Retire

Part of a sound retirement planning strategy involves choosing the best age to retire. The normal retirement age is typically 65 or 66 for most people; this is when you can begin drawing your full Social Security retirement benefit. It … Continue reading → The post What Are the Best Ages to Retire? appeared first on SmartAsset Blog.

SmartAsset

Can I Apply for an Ex-Spouse’s Social Security Benefit?

Marriage can affect how you do your taxes, make money and plan for retirement. If your marriage ends, it’s important to know the rules regarding divorce and Social Security. Who’s eligible for what benefits, how much can you collect and … Continue reading → The post Social Security Rules After a Divorce appeared first on SmartAsset Blog.

Bloomberg

OPEC+ Discusses Cutting Oil Output at Next Week’s Meeting

(Bloomberg) — Sign up for our Middle East newsletter and follow us @middleeast for news on the region.Most Read from BloombergApple Ditches iPhone Production Increase After Demand FaltersMacKenzie Scott Files for Divorce From Science Teacher HusbandNord Stream Gas Leaks May Be a New Disaster for the ClimateTrump Refuses to Delay Florida Deposition in Phone-Fraud Case Despite HurricaneGermany Suspects Sabotage Hit Russia’s Nord Stream PipelinesOPEC+ has begun discussions about lowering oil outpu

MarketWatch

Defamation lawsuit against Fox News, Lou Dobbs can proceed to trial

A defamation lawsuit against Fox Corp., Fox News Network and Lou Dobbs can proceed toward trial, a judge ruled Monday after concluding that a Venezuelan businessman had made sufficient claims of being unfairly accused of trying to corrupt the 2020 U.S. presidential election to be permitted to gather more evidence.

SmartAsset

This Is How Much Retirement Income You Need to Live Comfortably

Saving for retirement is perhaps the most major financial goal every American has. But once you retire, you’ll need an adequate income to replace what you were making pre-retirement. As you might imagine, this number will vary from person to … Continue reading → The post What Is a Good Retirement Income? appeared first on SmartAsset Blog.

Motley Fool

Why Oil Stocks Are In Rally Mode Today

Oil prices bounced higher on Wednesday. Notable names on the upswing today were Chevron (NYSE: CVX), Devon Energy (NYSE: DVN), Phillips 66 (NYSE: PSX), and Energy Transfer (NYSE: ET). Here’s a look at what’s fueling the oil market’s rebound and how it impacts these companies.